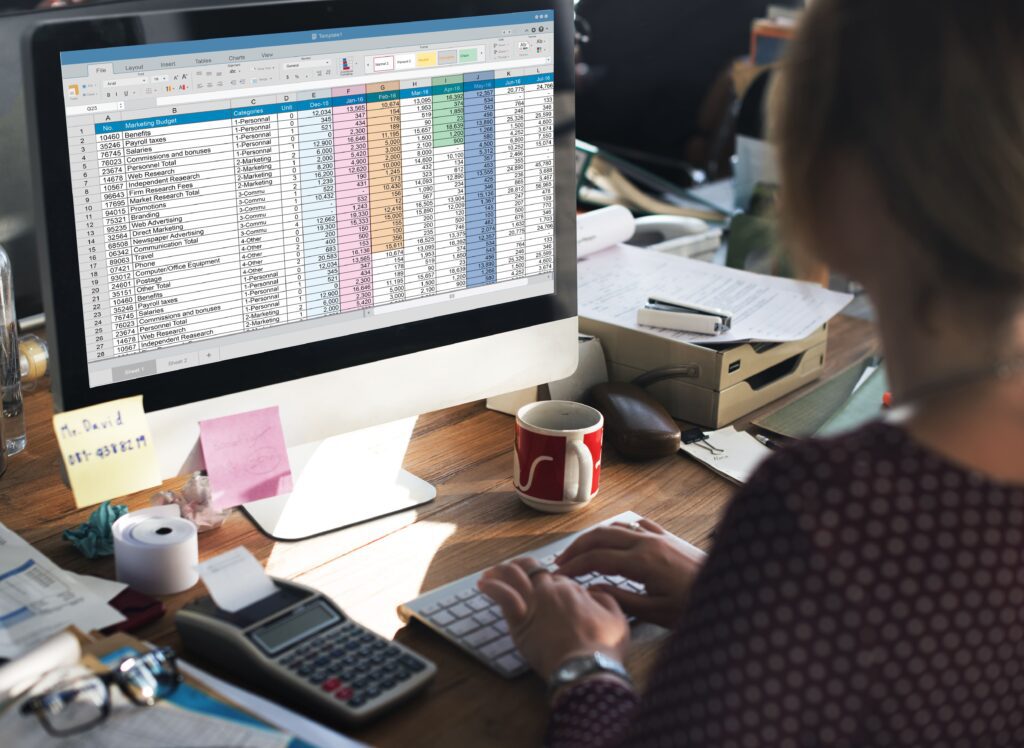

Why Every Business Needs an Accounting Process Manual (and How a Virtual CFO Can Build It)

Indian MSMEs are facing a compliance and accounting challenge that can quietly erode profits and operational efficiency. Recent reports highlight that businesses manage ~1,450 regulations and spend ₹13–17 lakh annually on compliance alone. Without a structured framework, finance teams often struggle with: Errors in reporting that can lead to penalties Time-intensive reconciliations that tie up […]

Top Financial KPIs Every Automotive Dealership Should Track in 2025

Are you tracking how much profit each vehicle at your automotive dealership actually generates? Do you know how F&I and service margins impact your bottom line, or how long your cars sit on the lot before they start costing you money? In 2025, rising floor-plan interest, tighter cash flow, and more demanding customers mean that […]

5 Red Flags That Show It’s Time to Outsource Accounting to a Virtual CFO

Are you confident that your books are always accurate, your taxes never slip, and your cash position is crystal clear? Or are you silently worrying about payroll errors, late filings, and unexpected surprises that a virtual CFO could help prevent from derailing your growth? Because here’s the truth: if your accounting is struggling, your business […]

Cross-Border SaaS Expansion: How Virtual CFOs Protect Margins While You Scale

Expanding your SaaS across borders sounds exciting, until you face what it really costs. Margins shrink fast when you’re hit with foreign taxes, currency swings, and 90-day receivable cycles. Add the wrong entity structure or mispriced plans, and what looked like growth on paper can turn into cash burn. That’s why a Virtual CFO matters. […]

Why Small Manufacturing Businesses Need an Affordable CFO: Key Benefits and How It Can Drive Growth

If you run a small manufacturing business in India, you already know the numbers are tight. Margins are pressured by rising costs, compliance is a constant drain, and finding affordable growth capital is harder than it used to be. Access to finance is shrinking. Only 42% of small businesses found it easy to get funds […]

COGS Explained: How to Classify Direct Costs the Right Way

Many businesses know their total expenses. But only few know that, how much of that truly belongs in the cost of goods sold. When direct costs aren’t clearly defined, financial reports start to mislead, gross margins look stronger than they are, or worse than they should. And over time, decisions based on that unclear picture […]

Advance Tax, TDS, GST: What Small Businesses Often Get Wrong

Most small businesses don’t struggle with tax rules, they struggle with how those rules play out in real-time decisions. A missed deadline here. An over claimed credit there. A payment made without checking deduction thresholds. Individually, they may seem minor. But for small businesses, these routine errors don’t just trigger penalties, they throw off cash […]

Finance Audit Checklist: Everything You Need to Be Audit-Ready

Most businesses believe they’re ready for an audit. But once the audit begins, things start to slow down. Files are missing. Numbers don’t add up. Processes take time to explain. What should be a quick review turns into weeks of back-and-forth. Audit delays don’t happen because your business lacks structure. They happen because the right […]

Avoid these 5 Financial Integration Pitfalls in Your Post-Merger Transition

Integration problems don’t usually start as strategy failures. They start as small operational decisions in finance. From inconsistent charts of accounts to unclear reporting rules, small gaps—often unnoticed unless a fract CFO Consulting is involved early—can drag out consolidation, delay close cycles, and block decision-making. This article breaks down five integration mistakes that show up […]

How CFOSME Builds Financial SOPs That Scale With Your Business?

Growth brings complexity. What once worked in a 5-person team starts falling apart at 50. Approvals get delayed. Reports go missing. People keep asking, “Who’s responsible for this?” And your finance function, instead of driving clarity, starts creating noise. At CFOSME, a leading provider of virtual CFO and CFO outsourcing services, we’ve seen this happen […]